Checking account

Open an online banking account

8 min read

04 Oct 2022

Nowadays it is very easy to open an online banking account. We will tell you about the aspects you should take into consideration and the different financial products you can obtain with these types of accounts.

Why open an online banking account?

We will tell you the advantages of opening an account through online platforms. By knowing some of these aspects, you will be able to take advantage of the benefits offered by this type of financial product, which are the following:

- Absence of commissions: When opening a digital account generally there is usually the possibility of not having bank debits by commission and, the realization of some movements at no cost.

- Without having to go to the agency: When opening a bank account through the platform, there are usually some requirements that can be sent by mail. In some financial institutions it is necessary to send them physically to determine the veracity of the documentation.

- No waiting to open the bank: By opening an online banking account, you have the possibility to perform banking transactions at any time, that is, 24 hours a day, 365 days a year.

- Ideal for new savers account: The requirements to open a digital account are the minimum required through the bank. And these will serve to open your financial file with which some aspire to obtain the coveted bank credit.

Requirements you must have to open an online account.

There are elements that you must possess in order to open an online banking account, among which are the following:

- Having an email address: Just by opening an email address or having your own is enough. There you will receive information from the bank in some moments, beyond simple advertising, you can acquire promotions before time, know important information about your account and of course, enhance the security of it.

- Smartphone: This must be your own, since the transactions will be recognized through the IP of the device and the double authentication factors are performed through the cell phone.

- About the documents: At the time of filling out the collections you should not lie about them, sometimes they must be shown physically, mainly if they fail to be corroborated by officials of the financial institution. Or simply, as an ordinary process performed by the institution.

- Follow the process: This must be done until the end, generally it is usually done in stages, where the basic data, personal data, employment data must be filled in consciously. An error can lead to the cancellation of the application and, in some occasions, affect the completion of a new process in the same equipment.

Open an online banking account

If you want to open the online banking account you only have to follow the steps below (because they are usually the same in the applications), to do this you must do the following:

- Open the applications from your Smartphone: Depending on the type of equipment, there you will have the possibility of being able to download from your mobile the application. It can be through different apps such as Google Store, among others.

- Locate the bank of your choice: To do this we recommend that you read the requirements, compare the advantages related to offers on purchases or commission. As well as the ability to make transfers, promotions or some elements that seem advantageous or ideal for your convenience.

- Check the application: For this you need to read the comments and verify that the application you are going to download on your cell phone is the ideal one.

- Download the application.

- Follow the steps.

- Have the requirements at hand.

Once you have completed the entire process, your physical card is waiting for you. You should generally look for it at the branch of the banking institution, you can receive it by mail or at home.

Conclusion

Starting a business as an immigrant is entirely possible with the right steps. By choosing the right business structure, obtaining the necessary tax IDs, and registering properly, you'll build a strong foundation for success.

Need an easy way to manage your business finances?

Común offers banking solutions designed for Latino entrepreneurs. Open your account today!

Olivia Rhye

Community Partner

Financial Education

What is direct deposit?

8 min of reading time

In the digital era in which we live, financial transactions have become faster and more efficient. One such facility is direct deposit, a solution that has revolutionized the way we receive our money. In this article, we will explore the definition of direct deposit, its uses and why it is so convenient.

Definition of direct deposit

Direct deposit is a method of electronic funds transfer that allows an entity (employer, government, etc.) to deposit money directly into the beneficiary's bank account. Unlike paper checks, this process eliminates the need to issue, deliver and cash physical checks, saving time and resources.

Common uses of direct deposit

- Employee payroll: One of the most popular applications of direct deposit is payroll management for businesses. Instead of issuing checks to each employee, companies can deposit wages directly into their employees' bank accounts.

- Government payments: Governments also use direct deposit to distribute payments to citizens, such as pensions, unemployment benefits and tax refunds.

- Money transfers: Individuals can also use direct deposits to send and receive money between bank accounts, facilitating transactions and payments between friends, family and businesses.

Advantages of direct deposit

- Speed: One of the greatest advantages of direct deposit is the speed at which funds are transferred. In general, direct deposits are processed more quickly than paper checks, allowing beneficiaries to have their money in less time.

- Security: Direct deposit is a more secure method than paper checks because it reduces the risk of check theft, loss or forgery.

- Saving time and resources: By eliminating the need to issue, deliver and cash physical checks, both companies and beneficiaries save time and resources. In addition, direct deposit is environmentally friendly, as it reduces the amount of paper used in financial transactions.

- Control over money: Direct deposit allows beneficiaries to access their money quickly and conveniently, giving them more control over their personal finances.

How do I connect the direct deposit

With mobile applications such as Comunyou can connect your direct deposit to your bank account in seconds. Comun lets you connect your direct deposit from the Comun app. Comun app or if you prefer your employer to do it, Comun gives you a completed form to give to your employer. In addition to the ease of connecting your direct deposit with Comunthe Comun app, the Comun app advances your payment up to two days in advance.

Conclusion

Direct deposit is a modern financial solution that offers speed, security and convenience in transferring funds. Whether it's for work, government payments or personal transfers, direct deposit has become a preferred option for facilitating transactions and managing money. Ultimately, this method simplifies our financial lives and allows us to focus on what really matters.

Living in the United States

Cashing Checks in the U.S.: Why is it so expensive and how does it affect Latinos? Solutions and Alternatives

8 min of reading time

In the United States, a common way to receive payments is through checks. However, cashing a check in the United States can be costly, especially for Latinos and other underserved communities. Here, we will explore why cashing checks in the U.S. is so costly and what solutions exist for those looking to cash their checks for free.

Why does it cost so much to cash checks in the United States?

One of the main reasons that cashing checks in the United States is so expensive is because many people do not have bank accounts. If you do not have a bank account, you may have to use a cash check company to cash your check. These companies charge high fees for their services and are often located in low-income areas, which means that Latino and underserved communities are among the hardest hit.

In addition, many banks charge fees for depositing checks, especially if you don't have an account with them. While the fees may seem small individually, they add up quickly, making check cashing costly for people already struggling to make ends meet.

Finally, there is the risk of check fraud. Cashiering companies and banks want to make sure checks are legitimate before paying them, which can take time and increase fees for the customer.

Why do Latinos suffer these costs?

Latino communities often have less access to banking and financial services, which means they are more likely to have to rely on cash check companies to cash their checks. In addition, many Latino communities are in low-income areas where these cash checking companies are located, which increases the cost of cashing checks. These businesses may also be located in dangerous or unsafe areas, making check cashing even more difficult and costly for Latino communities.

What solutions are available to cash checks for free?

Fortunately, there are several solutions for those looking to cash checks for free. One option is to open a bank account at a financial institution that offers free or low-cost accounts. Comun is a Spanish-language online bank that provides accounts with no monthly fees and no minimum balance requirements.

Comun provides the option of cashing checks through its mobile banking application. This option of depositing checks through a phone can be more convenient and economical than going to a cash check company.

There are also nonprofit organizations that offer free or low-cost cash checking services to low-income people. For example, the nonprofit UnidosUS offers a network of organizations with free and low-cost financial services to Latino and underserved communities.

In conclusion, cashing checks in the United States can be costly, especially for Latino and underserved communities that often have less access to user-friendly banking services. That's why we need to be well informed of our financial options.

Financial Education

What is the FDIC?

8 min of reading time

The Federal Deposit Insurance Corporation (FDIC) is a government agency that insures consumer deposits at FDIC-insured banks. This means that if your bank fails, the FDIC will reimburse you for your lost deposits.

The FDIC was created in 1933 in response to bank failures during the Great Depression. More than 1,300 banks failed between 1929 and 1933, causing many people to lose their money. It is a self-funded government agency, which means it receives its funding from the banks it insures.

The FDIC insures consumer deposits up to $250,000 per account. This includes deposit and savings accounts, as well as money market accounts.

The advantages of FDIC insurance are:

- Your deposits are guaranteed up to $250,000 per account.

- You can access your money at any time: 24 hours a day, 7 days a week.

- Your money is safe even if your bank fails

- Your bank does not have to be located in your city or state.

- There is no fee to join the FDIC or to have your bank insured by the FDIC.

- The FDIC has been in existence since 1933 and has never failed to reimburse depositors.

If you are interested in opening an account at an FDIC-insured bank, visit the FDIC's Web site and use the bank locator tool to find a bank near you. Some of the most popular banks with FDIC protection include:

- Bank of America

- JPMorgan Chase

- Citigroup

- Wells Fargo

- Capital One

- HSBC

- Ally Bank

- SunTrust Bank

- PNC Bank

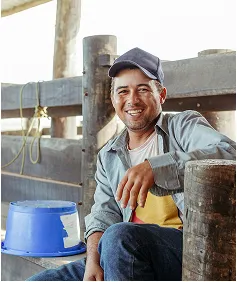

Community

How Comun Generates Money: A Transparent Look at Our Business

8 min of reading time

Founded by Mexican co-founders who themselves navigated the banking system as immigrants to the United States, Comun brings a unique perspective to the challenges facing its target audience.

Let's look at how Comun stays profitable through innovative revenue streams, cost-saving strategies and a deep commitment to its customers, emphasizing how these factors contribute to the ease and benefits of virtual banking for newcomers to the financial world.

Revenue Sources: Banking Services

Comun offers not only essential banking services¹, but also functions such as international remittances⁴, which provide significant benefits for Comun customers. Comun monitors cash flows and payment channels to ensure efficient and secure transactions. Consumers often pay high remittance fees with other services, but Comun offers a cost-effective alternative.

This service is crucial for immigrants who regularly send money home, increasing Comun s appeal as a banking solution that understands and responds to the specific financial dynamics of its users.

Cost Saving Strategies: Financial Inclusion

The strategic absence of physical branches allows Comun to minimize operating costs and maximize profits. Comun allocates resources to expand its outreach and improve financial services for Latino immigrant families. These savings are passed on to customers through lower fees and better rates, making financial services more accessible. Comun s digital platform facilitates banking access, offering 24/7 services that make money management safe and efficient from any browser or application.

Company Values and Customer Relationships

Comun advocates for financial inclusion, particularly among the Latino community, positioning itself among companies dedicated to serving Latino communities and enabling the setup of accounts with diverse international IDs. This inclusion strengthens trust and understanding between Comun and its customers, fostering a supportive banking environment.

Competitive Advantage

By creating a customer-centric digital bank that offers services in Spanish and accepts non-traditional IDs, Comun specifically addresses the barriers faced by Latino immigrants. This personalized service not only distinguishes Comun from its competitors, but also deepens customer loyalty and trust.

Target Audience

Comun focuses on Latino immigrants, a group often overlooked by traditional banks. In its latest round of funding, Comun raised $5 million in June 2022 to further develop its services. By offering accessible and empathetic financial services, Comun not only meets a significant market need, but also empowers its customers toward greater financial stability and integration into the U.S. economy. South Park Commons, along with Costanoa Ventures, has been instrumental in supporting financial inclusion banking solutions for Latino immigrant families in the United States.

Conclusion

Virtual banks like Comun present an easy-to-use, cost-effective and inclusive alternative to traditional banking, particularly beneficial for those who are new to banking or marginalized by conventional financial institutions. By focusing on accessibility, cost efficiency and customer-oriented services, Comun not only maintains profitability, but also significantly improves the banking experience for its users.

Living in the United States

5 Applications to earn money fast in the United States

8 min of reading time

Looking for ways to earn extra money from the comfort of your home or during your free time? Thanks to technology, it is now possible to do so with just a cell phone and an Internet connection. In this article, we present five applications that will allow you to earn money quickly and easily.

Eureka Surveys or Survey Pop:

1. Eureka Surveys is a platform that allows you to earn money by answering surveys in minutes on your own schedule. As you complete these activities, you will accumulate points that you can then redeem for gift cards or cash through PayPal. This application is one of the most popular in its category and has millions of users worldwide. Survey Pop works identically to Eureka Surveys as they are sister companies.

Google Opinion Rewards:

Google Opinion Rewards is an application created by Google that allows you to earn money by answering short surveys. These surveys are designed to collect information about your habits and preferences, which helps Google improve its products and services. For each completed survey, you will receive a reward that you can redeem in the Google Play store, allowing you to purchase apps, movies, books and other digital content for free or at a discount.

Fiverr:

3. Fiverr is a freelance services platform where you can offer your skills and knowledge in exchange for money. You can find jobs in various categories, such as graphic design, copywriting, digital marketing, programming and more. You just need to create a profile, post your gigs or services and wait for clients to hire you. Fiverr is an excellent option to earn money quickly if you have specialized skills and want to work from home. Remember to connect your account Comun account to Fiverr to receive your payments as quickly as possible.

Mercari:

4. Mercari is a buying and selling application where you can sell new or used items, such as clothes, electronics, toys and more. Just take photos of your products, add a description and set a price. Once a buyer is interested, Mercari will provide you with a transfer label so you can ship the item. The app takes a small commission on every sale made, but it's a quick and easy way to make extra money on things you no longer need.

Uber or Lyft:

5. If you have a car and free time, you can take advantage of transportation apps like Uber or Lyft to earn extra money as a driver. These apps connect you with passengers looking for transportation, and you will receive a portion of the payment for each trip taken. It is important to consider the costs associated with gas, vehicle maintenance, and insurance before you start working with these apps.

Earning money fast is easier than it seems thanks to these apps. Whether you prefer to answer surveys, sell items you no longer need or take advantage of your skills and free time, you are sure to find an option that suits your needs.

Remember that with Comun you receive a free checking account and a VISA debit card. With this account, you can save and manage your additional income from the app on your cell phone. You have access to your money at over 57,000 ATMs around the U.S.

Download these apps and start increasing your income today!

Immigration

Find out which institution charges the lowest fees for immigrants in the U.S. We compare Comun, Seis and Majority on rates, services and accessibility.

8 min of reading time

How to Avoid Membership Fees: Comun as the Best Alternative to Six and Majority

Membership Fees and Minimum Balance Requirements of Six

For many immigrants, finding a banking solution that doesn't eat up their hard-earned money in exorbitant fees is crucial. Seis, a popular banking service, offers several memberships but at significant costs:

- Basic Membership: $6 per month

- Premium Membership: $15.95 per month

If you opt for the premium membership, you could be spending more than $190 annually on membership fees alone. However, there is a way to avoid these fees altogether. Comun also imposes no penalties for early withdrawals, making it easier for users to access their funds when they need them.

| Feature | Comun | Six |

|---|---|---|

| Membership dues | $0 | $6 - $15.95 |

| Apply with foreign identification | ✅ | ✅ |

| Verify home address using geolocation on your phone | ✅ | ❌ |

| FDIC insured checking account | ✅ | ✅ |

| Debit card with fraud protection | ✅ | ✅ |

| Remittances from the application | ✅ | ❌ |

| 24/7 customer service | ✅ | ✅ |

How to Avoid Majority Membership Fees

Majority is another banking service that caters to immigrants, but also charges membership fees:

- Membership Fee: $5.99 per month

This adds up to about $70 per year. Again, there is a way to save this money. Comun also offers linked investment accounts, providing users with more financial management options.

| Feature | Comun | Majority |

|---|---|---|

| Membership dues | $0 | $5.99 |

| Apply with foreign identification | ✅ | ✅ |

| Verify home address using geolocation on your phone | ✅ | ❌ |

| FDIC insured checking account | ✅ | ✅ |

| Debit card with fraud protection | ✅ | ✅ |

| Remittances from the application | ✅ | ✅ |

| 24/7 customer service | ✅ | ✅ |

Banking Platforms: An Overview

Banking platforms have evolved significantly over the years, offering a range of services designed to meet the needs of various demographic groups. In the United States, traditional banks and financial institutions such as Chase, Bank of America and Wells Fargo dominate the landscape, providing comprehensive banking services including checking and savings accounts, credit cards, loans and investment opportunities. These banks have long-established infrastructures and offer a sense of stability and confidence.

However, traditional banks and financial institutions often have strict requirements and fees that can be prohibitive, especially for immigrants. This has paved the way for fintech companies and neobanks, such as Chime, Comun, Revolut, Seis and Majority, which provide more accessible and often more affordable banking solutions. These platforms leverage technology to offer mobile banking services, making it easier to manage finances without the need to visit a physical branch.

What is Comun?

Comun is a modern banking platform designed specifically for immigrants. It aims to provide essential banking services without the high fees and barriers often associated with traditional banks. With Comun, users can enjoy the benefits of a checking account, FDIC insurance, fraud-protected debit cards, remittances directly from the app and 24/7 customer service, all without membership fees. This makes Comun an attractive option for those looking for a reliable and cost-effective banking solution. Like credit unions, Comun offers better banking options and services to underserved communities, ensuring secure and affordable accounts.

What is Six?

Seis is a digital banking platform that aims to provide banking services tailored to the needs of the Latino community in the United States. It offers features designed to make banking more accessible and affordable for immigrants. Seis provides services such as checking accounts, debit cards and mobile banking, with a focus on convenience and community support. In addition, Seis supports direct deposits, which is particularly beneficial for users who receive government income and payments. However, unlike Comun, Seis charges membership fees, which can add up over time.

What is Majority?

Majority is another digital banking platform designed to cater to immigrants in the United States. It focuses on providing banking services along with additional support features such as international calling and discounts at partner retailers. Majority offers a variety of financial products, including mobile banking and online payment services, tailored to the unique needs of immigrants. Majority seeks to help immigrants integrate more easily into their new environment by offering financial services tailored to their specific needs. Like Seis, Majority charges membership fees for access to its services.

Pros and Cons of the Historical Evolution of Banking, Financial Institutions and Third-Party Applications

The evolution of banking has brought significant changes, particularly with the introduction of third-party applications. These changes have their own advantages and disadvantages. The financial system plays a crucial role in providing secure and affordable banking services, especially during economic challenges.

Pros:

- Accessibility: Third-party banking apps have made financial services more accessible, especially to underserved populations such as immigrants. With fewer barriers to entry, more people can open and manage bank accounts.

- Affordability: Many of these applications offer low or no fees, making banking more affordable. This is especially beneficial for those with limited financial resources.

- Convenience: Mobile banking applications provide the convenience of managing finances from anywhere, anytime. This eliminates the need to visit physical branches and enables real-time transactions.

- Innovative Features: These platforms often come with innovative features such as real-time expense notifications, easy money transfers and budgeting tools, enhancing the user experience.

Cons:

- Limited Features: Although third-party applications offer many benefits, they may lack some of the full services provided by traditional banks, such as extensive lending options and investment services.

- Trust and Security: Some users may be wary of entrusting their money to newer, lesser-known fintech companies. While these platforms offer security features, they may not have the long-standing reputation of traditional banks.

- Customer Support: While many third-party applications offer customer support, the quality and availability can vary. Traditional banks generally have a more robust customer service infrastructure.

- Regulatory Challenges: Fintech companies often face regulatory hurdles, which can affect their operations and the services they provide.

How Can Comun Help?

- Comun s Limited Features Solution: Comun focuses on providing all the essential banking features needed for everyday use, such as checking accounts, fraud protection and remittance services, ensuring that users have what they need most without additional costs. In addition, Comun offers many features such as real-time spending notifications and budgeting tools to help users better manage their finances.

- Comun s Solution to Trust and SecurityComun offers FDIC-insured accounts and robust fraud protection measures, providing a high level of security and building trust among its users.

- Comun s Customer Support Solution: Comun provides 24/7 customer service in multiple languages, ensuring that users can receive help when they need it, matching and even surpassing the support provided by traditional banks.

- Comun s Solution to Regulatory Challenges: Comun complies with all necessary regulatory requirements, ensuring a stable and legally sound operation that users can rely on for their banking needs.

How Comun Supports Students: Immigrant Students

For college students, especially those studying abroad, managing finances can be a significant challenge. Comun offers several features that make it an excellent choice for students:

- Ease of Sending and Receiving Money: Students can easily send money to or receive financial support from their families back home using Comuns remittance services. This is especially useful for international students who need to transfer money across borders.

- No Membership Fees: With no monthly fees, students can save money for their education and living expenses.

- Accessibility: The ability to apply with a foreign ID and verify your address using geolocation makes it easy for international students to open an account without the complications of traditional bank requirements.

- 24/7 Customer Service: 24-hour customer service ensures that students can get help when they need it, regardless of time zones.

- Building an Emergency Fund: Comun s features can help students build an emergency fund, which is crucial to cover three to nine months of living expenses and achieve short-term financial goals.

Why Choose Comun? A Range of Financial Products

With Comun, users get access to all the features they would expect with a checking account without the absurd fees. Comun provides an FDIC-insured checking account, fraud-protected debit card, remittances directly from the app and 24/7 customer service, all with no membership fees. Comun also helps users achieve their savings goals, such as saving for education or emergencies. This makes Comun an ideal choice for immigrants looking to save money and avoid unnecessary costs.

By choosing Comun sobre Seis or Majority, immigrants can enjoy essential banking services without the financial burden of membership fees, contributing to better financial health and stability. Make the switch to Comun today and keep more of your hard-earned money.

Instant payments

What is Venmo and how does it work? The definitive guide for immigrants in the United States

8 min of reading time

Have you heard of Venmo? It is a digital payments app that has become popular in the United States in recent times. According to recent data, in 2024 the mobile app reached 68.3 million active users, which represented an increase of 8.8% over 2023.

There is no denying the importance that this application has acquired, so knowing what Venmo is in the United States could be very useful to send and receive money to your family and friends quickly and securely.

As a foreigner living in the U.S., you should make sure you opt for a financial platform that meets your needs to send money to your home country and make payments with ease.

On this occasion, we clarify all your possible doubts about how to use Venmo in other languages such as Spanish, what it is for, what are the requirements to open an account, the benefits offered by this app and also its limitations.

What is Venmo and how does it work?

Venmo is a P2P (person-to-person) payment application very popular in the U.S. Its main purpose is to facilitate instant money transfer between friends and family, as well as to connect bank accounts and cards.

Venmo's business model consists of charging fees for the services it offers, such as credit card fees, fees for instant money transfers to bank accounts and physical card transactions.

Some of the most common reasons among immigrants for using Venmo are as follows:

- Pay monthly rent

- Collecting wages from casual employment

- Paying or collecting money from friends and relatives

- Lending or repaying money to acquaintances

Key features of Venmo: What can you do with it in the U.S.?

To understand what Venmo is in the United States, it is necessary to delve into the functionalities that this service offers its users through a P2P payment application to make their lives easier:

instant transfer and receipt of money between Venmo users

These are the most important functionalities of the application, since in addition to allowing instant transfers, they do not generate commissions between Venmo users.

It also allows you to add notes or emojis to identify each transaction and use the balance of the app itself or a synchronized bank account.

Use of Venmo (Mastercard) debit card for purchases

Venmo also offers a physical debit card for purchases at physical merchants. It is valid at any merchant that accepts Mastercard in the United States.

In addition, it includes an extra benefit, since each purchase with the debit card accumulates cash back to save even more.

Direct deposit to receive salaries and benefits

You can use your Venmo account to receive your salary or other types of transfers. To do this you only need to use your personal QR code.

Bank transfers to bank accounts

Venmo offers two types of bank transfers. Standard transfers, which are free and take 1 to 3 business days. And instant transfers, which generate approximately 1.75% commission and arrive in minutes.

Payments to merchants and businesses that accept Venmo

Another advantage of this service is Pay with Venmo, which allows you to pay at physical or digital establishments that accept Venmo.

This streamlines the transaction and allows the balance deposited in the application to be used directly.

Social functionalities: comments, "likes" and division of expenses

Finally, a feature that makes Venmo more attractive is the possibility of adding comments, likes and emojis.

This allows you to request payments to friends and family, add reminders and split expenses among several users.

Business profiles for companies

Venmo allows small businesses and freelancers to create a business profile to receive payments directly into their account, via their username or QR code.

What do I need to have Venmo? The reality of its availability

Now that you know in detail the benefits of this application, you will surely want to know the requirements to start using it.

Before learning how to pay with Venmo, remember that it only works in the United States.

These are the requirements for using Venmo:

Have an Android or iOS phone

As this is a mobile application, it is essential to have a cell phone compatible with Android or iOS, as well as to download the app from the corresponding store.

Register with personal phone number

To register in the application, you must have a U.S. phone number and reside in the U.S., as Venmo is only available in this country. You can also register with an email address.

Link your U.S. bank account

Linking a bank account is not mandatory to create your Venmo account; you can receive money and pay with your balance or with a card. However, most features require a linked bank account.

Link a debit or credit card

Another option to access all of Venmo's features is to link a credit or debit card instead of a bank account. This will allow you to use the balance on that card to make transactions directly from the mobile app.

Validate your account

Validation of your account is a requirement to access all Venmo features, in order to corroborate the identity of users. Features include: making weekly transfers of up to 60,000 but only if you are a verified user with a verified SSN or ITIN number. For non-verified users, the weekly transfer amount is up to $299.99.

To validate your account, Venmo will ask you for the following requirements:

- Full legal name

- Mailing address in the United States

- Date of birth

- SSN (Social Security Number) or ITIN (Individual Taxpayer Identification Number)

How do I transfer money from Venmo to my bank account?

To transfer money from Venmo to your bank account, once you have associated it with your Venmo account and verified it, follow the steps below:

- Log in to your account from the app and go to the "Me" tab.

- Press the "Transfer" or "Add" button.

- Enter or edit the amount you wish to transfer to your bank account

- Select the transfer method: "Instant" or "up to 3 biz days", depending on whether fees apply.

- Confirm your transfer information and make the transfer.

Limitations of Venmo for immigrants: Why is it not the complete solution?

Immigrants' need for a one-stop solution that allows them to access digital payments, transfers and other benefits is growing every day. So while Venmo is a popular alternative for sending and receiving money in the U.S., it can present limitations for immigrant users working in the U.S.

One of the limiting factors for immigrant communities is the language of customer support. Because it is a service geared to the needs of Americans, it is not optimized for people who speak other languages, such as Spanish. In addition, you should have a U.S. bank account.

Your best option may be to entrust your assets to a service offered in your language.

Comun: An excellent alternative to Venmo for the immigrant community in the U.S.

Introducing Comun, the solution for immigrants looking to improve the way they send and receive money to family and friends.

Why is Comun a great option for immigrant communities in the United States?

- Comun allows you to open your account with your country's official ID.

- It is a platform also available in Spanish without complicated terms.

- Unlike Venmo, Comun allows you to send remittances to Latin America, for an affordable fee, starting at 2.99 USD, up to the applicable limits.

- Access a mobile application to make your transactions from the palm of your hand.

If you think that having quality financial services in the U.S. is impossible for immigrants, open your Comun account today and forget the hassle.

Checking account

What is online banking?

8 min of reading time

Online banking is a financial entity that has a digital presence on the web and can be accessed through different devices. Online banking has particularities that differentiate it from other platforms, its main feature is due to the management of money and resources that are made online. Among the main aspects that differentiate it from conventional banking and other platforms are the following lines, read on!

Online Banking Features

Now that you know what online banking is, we will tell you about its different features:

Practicality: It is not necessary to perform part of the operations through the web and complete them in person at the bank. Online Banking has the possibility of performing 100% online operations depending on the bank.

Functionality: Banking today has improved the user experience to such an extent that its different applications are user friendly. Offering a wide range of financial products and instruments, allowing the user to avoid having to make some physical confirmations at the bank.

Security: This is one of the most important aspects of online banking. And this has been one of the factors that limited in the past to offer financial products to customers. Today there is a great diversity of elements that make the execution of transactions through the web safe, among which are the following:

Banking software: Banking has internal software, which ensures the security of users. As in the payment methods, in the identification and recognition of IP location, as well as in the payment processing and authentication.

Double Factor: With the mobile application, security levels are ideally guaranteed through online banking.

Security protocols: These are the steps to access some financial instruments. There are some protocols that are necessary to verify through double factor, another through random coordinates depending on the criteria of the bank.

Advantages of Online Banking.

Over the years, online banking has optimized its digital processes, achieving a number of benefits for users, among which are:

Time saving: It is not necessary to go to the bank branch to carry out a transaction and wait to be attended, after a long time in the agency.

Improved communication: Complaints are addressed in a relevant manner on many platforms. Generally, the solution is found in one of the menus within the application. This is mainly due to the standardization of the solution to the most recurring problems that conventional users have and are options within the platform.

Process optimization: The ease of acquiring financial products, opting for promotional cards, carrying out domestic and international transactions, as well as knowing in real time the consumption made in a given period of time, make online banking an ideal option.

Ease: To be able to access the options offered by the platform makes navigation within the application (in the case of smartphones) or platform extremely user-friendly.

For these reasons it is necessary to know and deepen the different operations related to online banking among which are:

Open an online bank account.

Make Transfers by Internet.

Obtain benefits through online banking.

Affiliating payments in the bank.

Community

Comun Seeks to Save Latinos Hundreds of Dollars in Remittance Fees by Introducing Secure International Transfers

8 min of reading time

Starting today, all Común customers will have access to free international money transfers for a limited time. Thereafter, the fee will start at $2.99.

Sending international money transfers, also known as remittances, can be costly, given the additional fees consumers face from financial institutions and other non-bank service providers. This is an area particularly relevant to the Latino community. According to a recent report by the Inter-American Development Bank, remittances to Latin America and the Caribbean will reach an all-time high in 2023, reaching $155 billion, an increase of 9.5% compared to 2022 ($142 billion). At Comun , we believe that transfer remittances should not come at a high cost. Today, we are pleased to announce that all Comun customers can send money to Latin America free of charge for a limited time. Thereafter, the fee will start at $2.99, which is lower than what other providers offer.

To put into perspective how much Latinos can save on fees with international money transfers, Comun analyzed and compared the cost of using providers like Western Union or Remitly versus Comun. In addition, we wanted to know how customers interact with Comuns new money transfer feature, which became available in March 2024.

For the analysis, we first looked at the average number of remittance transfers that Comun s clients send monthly; in this case, it was two transfers. Using the knowledge of Comuns customers, the report analyzed the most common countries to which customers send money. Finally, we examined how much a consumer could save on remittance fees over a one-year and five-year period if they used Comun versus Western Union or Remitly, assuming they sent two money transfers each month.

Key findings

- Comun clients' money transfer destinations: Comun clients were most likely to send remittances to Mexico, followed by Honduras, Guatemala, Colombia and Nicaragua.

- Paying in person to send money internationally can cost hundreds of dollars: Based on our analysis, assuming a person sends two remittances per month and pays in person (e.g., by visiting a Western Union location), fees can amount to $960. By using a service like Comun, users can save nearly $600 in fees over five years. In addition, Comun customers have the convenience of sending remittances directly from their phones.

- Even if users can avoid paying in person and want to send remittances from a bank account, sending money overseas is still costly: Our analysis found that for users who want to send remittances directly from a U.S. bank account, using a service like Comun instead of Western Union and Remitly can save consumers more than $20 in one year and $120 over five years.

| Countries with highest remittance transfers |

|---|

| Mexico |

| Honduras |

| Guatemala |

| Colombia |

| Nicaragua |

| Western Union | Western Union | Remitly | Comun | |

|---|---|---|---|---|

| Method of payment | Pay in person, receive in cash or in a bank account | Pay by bank transfer, receive in cash | Pay by bank transfer, receive in cash | Pay by bank transfer, receive in cash |

| Delivery time | In minutes | 0-4 business days | 3-6 days | In minutes¹ |

| Variable rate | $8.00 | $3.99 | $3.99 | starting at $2.99 |

| Cost in rates for one year | $192.00 | $95.76 | $95.76 | $71.76 |

| Cost in tariffs for five years | $960.00 | $478.80 | $478.80 | $358.80 |

| Savings: How much consumers can save by sending remittances with Comun for a year | $120.24 | $24.00 | $24.00 | -- |

| Savings: How much consumers can save by sending remittances with Comun over five years | $601.20 | $120.00 | $120.00 | -- |

For more information about Comun and its latest remittance offer in conjunction with a U.S. bank account and debit card, click here.

Methodology

Our analysis included several data points such as:

- To determine the most common countries to which Comun customers send money and the average number of transfers each month, we examined customer usage between March 7, 2024 and April 15, 2024.

- To understand how much customers can expect to pay to send international money transfers, we analyzed Western Union and Remitly fees. Our analysis examined how much an individual pays in remittance fees if 1) they pay in person, i.e., walk into a Western Union location to send a transfer, and 2) an individual sends money through their bank account, and the recipient picks it up in cash at their destination.

A service provided by Service UniTeller, Inc. Service UniTeller, Inc. is licensed in all states that require a license.

¹ Delivery times may vary.

²Terms and Conditions here. Terms and Conditions apply. Limited time offer. Service UniTeller, Inc. is licensed in all states that require a license. Comun, Inc. and/or UniTeller Service, Inc. may earn income from foreign currency conversion. Rates are subject to change. Service UniTeller, Inc. and/or Comun, Inc. reserve the right, at any time, without prior notice, to add, modify or cancel any and/or all terms of the promotion, or replace, in whole or in part, the promotion with another offer without liability to Service UniTeller, Inc. and/or Comun, Inc.

International Shipments

Which banks have Zelle in Mexico? Complete guide to send and receive money from the U.S.

8 min of reading time

Have you heard of Zelle? It is a very popular digital payment platform in the United States. It allows you to easily send and receive money between users with affiliated bank accounts, whether they are traditional banks, digital banks or credit unions.

In 2024 alone, Zelle registered 151 million registered accounts, including individuals and small businesses, reflecting its acceptance among U.S. users.

If you need to send money outside the United States with ease, such as Mexico, you are probably wondering which banks have Zelle in Mexico.

However, this platform does not have agreements with any bank in Mexico, and it is mandatory to have a U.S. bank account to access its services.

However, there are other options as efficient as Zelle for sending money to Mexico, such as accounts with integrated remittance services and international remittance applications.

Here we will explain how to receive money through Zelle, the benefits it offers for users in the United States and the alternatives to send money to other countries.

What is Zelle and is it possible to use it in Mexico?

Zelle is a digital payment service that facilitates P2P (person-to-person) transfers at certain U.S. treaty banks.

It is characterized for being a fast service, with money transfers that are reflected in a matter of minutes, plus it is free of charge and has a wide coverage within the United States.

It works through the applications of the participating banks, since it has a direct connection with them and it is only possible to make money transfers to other Zelle users.

But, which bank in Mexico is compatible with Zelle? Unfortunately, in Mexico it is not possible to send and receive money through this platform, since it is not designed for international money transfers, as it only meets the technological and regulatory standards of the U.S. financial system.

Which banks in Mexico use Zelle? Everything you need to know

No bank in Mexico is compatible with Zelle's services, so you will not be able to make international money transfers through this platform.

To use Zelle you must have a U.S. bank account at one of the affiliated banks.

This is a list of some of the banks that have Zelle in the United States:

- Ally Bank

- Bank of America

- BMO Harris Bank

- Capital One

- Chase (JPMorgan Chase)

- Citibank

- Citizens Bank

- Discover Bank

- Fifth Third Bank

- FirstBank

- Frost Bank

- Huntington Bank

- PNC Bank

- Regions Bank

- TD Bank

- Truist Bank

- US Bank

- Wells Fargo

Although Comun is not integrated with Zelle, this does not limit its operation, because it is a comprehensive personal finance solution, beyond money transfer .

How to send money to Mexico with Zelle? The answer and efficient alternatives

If you need to send money to Mexico quickly, you will have to opt for a different service than Zelle, as it only allows bank transfers between U.S. accounts.

The main reasons why there is no Zelle in Mexico are:

- To register with Zelle you need to access the online banking of one of the affiliated banks, all of which are U.S. banks.

- You also need a U.S. phone number or email address.

- Zelle is not a remittance or international payment platform, so it does not have the ability to convert currencies or deposit funds in international banks.

- Zelle does not comply with the regulations of financial institutions in Mexico, such as Banxico and the CNVB.

In case you have used Zelle to send money within the United States, you are probably looking for an equally reliable system for international money transfers.

U.S. bank accounts with integrated remittance services

In addition to traditional banks, there are alternatives that have integrated remittance services to facilitate the transfer of money to Mexico.

Comun is a platform that fits the needs of many people in the United States, especially the immigrant community, by allowing the transfer of remittances to loved ones easily, at a very low cost and from a single mobile application.

International money transfer platforms

Another alternative to make international money transfers are the platforms specialized in this type of operations.

Some examples are:

- Wise: money transfer between accounts with real-time exchange rates

- Remitly: international money transfers with standard or instant transfer

The advantage of these platforms is that it is not mandatory to have a bank account and their operation is accessible, although the transfer fees are variable according to factors such as the amount to be sent and the exchange rate.

Traditional international wire transfers in Mexico

You can also choose to make money transfers through traditional banks, for this you will need the SWIFT code of the receiving institution in Mexico, as well as the recipient's information.

Although it is a safe option, it is also one of the most expensive, due to the high commissions and the participation of intermediaries that raise the cost.

For example, a US bank such as Bank of America charges a $45 USD commission plus an average 1% to 3% exchange margin. Therefore, for a transfer of 1000 USD, the recipient receives approximately 900 MXN pesos less than with platforms specialized in international shipments.

Cash deposit/withdrawal services in commercial networks

In case the recipient does not have access to a bank account, you can opt for a cash deposit and withdrawal service in physical branches.

Some examples are:

- Western Union: global network for bank wire and cash transfer

- MoneyGram: allows bank account and cash remittances

- Comun: you can also send cash in a fast way.

Beyond Zelle: Comun simplifies your financial life in the U.S. and your money transfers to Mexico

Although Zelle is a very efficient service for sending and receiving money in the United States, it has limitations that prevent international money transfers, so it is more oriented to citizens who need to make frequent payments within their territory.

In the case of the immigrant community in the United States, it is important to choose a solution that not only facilitates the transfer of money, but also offers a complete financial platform that is accessible and simple to manage.

Comun is the platform that will make your financial life in the United States easier, as it offers the following benefits:

- Open an account easily, with the official identification of your country.

- Forget about traditional fees: there is no set-up fee, no monthly fee and no minimum balance.

- There are no hidden fees for remittance transfer , make your first international transfer for free and then pay as low as $2.99 USD per transfer, up to the applicable limits.

- Technical support also available in Spanish.

- Integrate your finances and remittance transfer service in the same mobile application, making Comun an easy and secure option.

- Get a Visa debit card to make payments at physical stores.

- Access an extensive cash management network and make deposits at thousands of locations near you.

Open your account at Comun and access a hassle-free financial service.

Frequently Asked Questions

Do I need a US account to use Zelle?

Yes, Zelle is only available through the online banks of affiliated U.S. banks.

Can I send money to Mexico through Zelle if I have a U.S. account?

No, no bank in Mexico is compatible with Zelle.

What are the best alternatives to Zelle for sending money to Mexico?

Comun: a fintech platform that allows you to access an account and transfer remittances.

Does Zelle offerComun to send money to Mexico?

Comun has no connection with Zelle, but you can send money to Mexico from $2.99 USD per transfer, up to the applicable limits.

How to put Zelle in Spanish?

As this service is available in the applications of the affiliated banks, you must access their configuration options and choose the Spanish language.

How to download Zelle?

Enter the Play Store or App Store and search for Zelle. Remember that it is only available in the United States.

Living in the United States

Cashing Checks in the U.S.: Why is it so expensive and how does it affect Latinos? Solutions and Alternatives

8 min of reading time

In the United States, a common way to receive payments is through checks. However, cashing a check in the United States can be costly, especially for Latinos and other underserved communities. Here, we will explore why cashing checks in the U.S. is so costly and what solutions exist for those looking to cash their checks for free.

Why does it cost so much to cash checks in the United States?

One of the main reasons that cashing checks in the United States is so expensive is because many people do not have bank accounts. If you do not have a bank account, you may have to use a cash check company to cash your check. These companies charge high fees for their services and are often located in low-income areas, which means that Latino and underserved communities are among the hardest hit.

In addition, many banks charge fees for depositing checks, especially if you don't have an account with them. While the fees may seem small individually, they add up quickly, making check cashing costly for people already struggling to make ends meet.

Finally, there is the risk of check fraud. Cashiering companies and banks want to make sure checks are legitimate before paying them, which can take time and increase fees for the customer.

Why do Latinos suffer these costs?

Latino communities often have less access to banking and financial services, which means they are more likely to have to rely on cash check companies to cash their checks. In addition, many Latino communities are in low-income areas where these cash checking companies are located, which increases the cost of cashing checks. These businesses may also be located in dangerous or unsafe areas, making check cashing even more difficult and costly for Latino communities.

What solutions are available to cash checks for free?

Fortunately, there are several solutions for those looking to cash checks for free. One option is to open a bank account at a financial institution that offers free or low-cost accounts. Comun is a Spanish-language online bank that provides accounts with no monthly fees and no minimum balance requirements.

Comun provides the option of cashing checks through its mobile banking application. This option of depositing checks through a phone can be more convenient and economical than going to a cash check company.

There are also nonprofit organizations that offer free or low-cost cash checking services to low-income people. For example, the nonprofit UnidosUS offers a network of organizations with free and low-cost financial services to Latino and underserved communities.

In conclusion, cashing checks in the United States can be costly, especially for Latino and underserved communities that often have less access to user-friendly banking services. That's why we need to be well informed of our financial options.

Instant payments

5 best apps to send money in the U.S.

8 min of reading time

In the digital age, sending and receiving money has become easier and faster than ever. There are mobile apps that allow us to transfer funds to friends, family and businesses with just a few clicks on our phone. In this article, we introduce you to the best and most popular apps for sending money securely and efficiently.

1. Zelle:

Zelle is a money transfer application developed by a consortium of U.S. banks that allows users to send and receive money directly between bank accounts. Because it is linked to bank accounts, Zelle offers a fast and secure way to transfer money without the need for a third-party application. To use Zelle, all you need is an email address or cell phone number and an account at a participating bank. While it may be the most popular option in the U.S. right now, it has a lot of work to do to improve accessibility in Spanish.

2. Comun:

Of the apps on this list Comun is, without a doubt, the best for the Latino community in the United States. The Comun app experience is completely in Spanish, clear and fast. It has 100% customer service in Spanish. With phone lines, chat, and text messaging, Comun is the most accessible money transfer app for answering questions. In addition to unlimited personal transfers, Comun also offers a bank account and guides to connect Comun with Zelle, Paypal, Venmo and Cashapp. That's right, apart from being one of the best apps for sending money, with Comun you can connect to all the apps on this list. Comun accounts are FDIC insured up to $250,000.

3. PayPal:

PayPal is undoubtedly one of the most popular and widely used online payment applications in the world. With a global presence in over 200 countries, it allows users to send and receive money in different currencies. In addition to personal transfers, it is also widely used for online payments in stores and e-commerce platforms. It has a buyer and seller protection function that provides greater security in transactions.

4. Cash App:

Cash App, developed by Square, is another popular app for sending and receiving money in the United States. With Cash App, you can link your debit or credit card to make quick payments to friends and businesses. In addition, the app allows you to buy and sell cryptocurrencies such as Bitcoin and offers a rewards program called "Boosts," which provides discounts on purchases at selected merchants.

5. Venmo:

Venmo is an application owned by PayPal, especially popular among young people in the United States. It allows you to send and receive money quickly between friends and acquaintances, even with personalized messages and emojis. Although Venmo is free for personal transfers, it has a small fee for receiving payments for services or sales. A distinctive feature of Venmo is its social component, as it allows users to view and comment on their friends' public transactions.

Sending and receiving money has never been easier than with these popular and trusted applications. Each offers unique features and advantages, from the global presence of PayPal to the flexibility and accessibility of Comun. Be sure to research and compare the different applications to find the one that best suits your needs and preferences - start transferring money quickly and securely today!

Checking account

What to do if your Alza account was closed

8 min of reading time

Similarities between Alza and Comun

Sending money to Latin America: Both Alza and Comun offer remittance services, allowing users to send money to friends and family in Latin America quickly and efficiently.

Debit card and checking account: Users of both platforms receive a debit card linked to a checking account; Comun offers a Visa card, allowing worldwide transactions and access to funds.

Virtual Visa debit card: Comun provides a checking account linked to a physical and virtual Visa debit card, emphasizing the importance of this offering for the financial stability and inclusion of Latino families.

Flexible application process: Both platforms allow users to apply for an account using various forms of identification, such as international passport, consular card, SSN or ITIN.

ATM fee reimbursement: Alza users could withdraw cash from any ATM worldwide with full fee reimbursement. Comun also supports ATM withdrawals, ensuring convenient access to cash.

Advantages of switching to Comun: Modern Banking Solutions

One of Comun 's outstanding features is its commitment to transparency and profitability. Unlike traditional banks and even Alza, Comun charges no set-up fees, no monthly maintenance fees, and no minimum balance requirements. This makes it an ideal option for those looking to avoid unnecessary banking fees and keep more of their hard-earned money. Here are some more outstanding features of a Comun account:

Financial Inclusion: Comun is dedicated to promoting financial inclusion by providing modern banking solutions tailored to the unique needs of Latino families. They address the challenges Latinos face in accessing traditional financial services and emphasize the importance of financial education. This commitment ensures that the Latino community has access to an inclusive and supportive banking experience.

Broader acceptance of identifications:

- Comun: Accepts any official government-issued ID, not just passports or consular cards. This makes it easier to open an account for a wider range of people.

- Alza: Limited to specific forms of identification, which may be restrictive for some users.

Simplified address verification:

- Comun: Applicants can verify their residential address using geolocation on their phone. This feature is particularly beneficial for immigrants who may not have traditional proof of address documents.

- Alza: Required physical proof of address, which can be a challenge for those in non-permanent housing or living with relatives.

Extensive cash deposit network:

- Comun: Offers access to the largest cash deposit network in the U.S. with more than 90,000 locations, including popular retailers such as Walgreens, Walmart and Dollar General.

- Upside: It did not specify such an extensive cash deposit network, limiting the convenience for cash deposits.

24/7 customer service:

- Comun: Provides customer service 24 hours a day, 7 days a week, ensuring that help is available at any time, any day of the week.

- Upside: Customer service availability was not highlighted as a 24/7 feature.

With Comun, you'll never feel alone in managing your finances. They offer top-notch customer service available seven days a week via chat, email or phone. This means you can get help whenever you need it, making your banking experience smooth and worry-free.

Open your checking account¹ in 3 minutes with any valid ID from your home country²

- No minimum balance commissions

- Easily connect to apps like Zelle

- Receive your paycheck up to 2 days in advance³

- Send money to your country safely

- and much more!

Making the switch to Comun: Financial Inclusion

Switching from Alza to Comun is simple and hassle-free. As a trusted financial partner, Comun understands the unique needs of Latino families. You can apply for a Comun account online in minutes using a variety of identification documents such as a passport, consular card or ITIN. Once your account is set up, you can easily transfer your funds to Comun. The fastest way would be to withdraw cash from your Alza account and then deposit it at any cash deposit location offered by Comun using the barcode option in Comuns cash deposit feature.

The transition from Alza to Comun is designed to be seamless and straightforward, helping you achieve financial freedom. Here's how you can make the switch:

Open a Comun account: Visit the Comun website or download the Comun app to start your application. Use any government-issued ID and your phone's geolocation to verify your address.

Transfer your funds: To transfer your funds to your Comun account, we recommend first withdrawing cash from your Alza account. Then, you can go to any cash deposit location offered by Comun and deposit your cash using the barcode option. This option does not require you to have your physical card, so you can deposit cash from your Alza account immediately after being approved for a Comun account.

Another quick option that does not require your Comun card is to transfer your Alza funds directly from your Alza account to your Comun account using your account number and routing number. You can find this information in Account Information under Settings.

Set up direct deposit: Update your direct deposit information with your employer or other income source to ensure uninterrupted access to your funds.

Current Comun offers

One of Comun 's core principles is inclusivity. As a customer-focused digital bank, Comun does not require a Social Security Number (SSN) to open an account. Unlike many traditional banks, this feature is particularly beneficial for immigrants and individuals who may not have access to traditional forms of identification. Comun focuses on providing secure banking solutions for everyone, regardless of immigration status. Comun also seeks to be a financial hub for Latino immigrants, offering a comprehensive banking solution with expanded resources tailored to their needs. To welcome Alza's former customers, Comun has several incentives:

- Hassle-free application: Apply using any government-issued ID and verify your address easily through your smartphone.

- Enhanced customer support: Benefit from 24/7 customer service to assist with any queries or problems during your transition.

- Extensive cash deposit options: Enjoy the convenience of depositing cash at more than 90,000 locations nationwide.

Conclusion: Secure your financial future with Comun for Financial Stability

As Alza prepares to close its doors, Comun offers a robust and easy-to-use alternative that not only matches but surpasses the services provided by Alza. With no fees, an extensive cash deposit network and unmatched customer support, Comun is the ideal banking solution for former Alza customers. Make the switch today and experience the superior banking experience Comun has to offer.

Make the switch today and experience the benefits of a banking platform that truly puts you first. Visit Comun s website to learn more and start your new banking journey.

For more information and to start your application, visit Comuns official website here: https://www.comun.app.

Checking account

Comun Bank Account Security: Empowering Your Financial Journey

8 min of reading time

In a world where financial stability is crucial, Comun stands out as a beacon of innovation in the traditional banking industry. Partnered with trusted banks like Community Federal Savings Bank, both FDIC Members, Comun offers a secure¹ foundation for managing your finances. Here's how Comun is changing the game for its customers and anyone seeking financial freedom and inclusion.

Partnered with Trusted Banks for Maximum Security

Comun is not just a fintech company¹; it is a mission-driven platform designed to enable upward mobility through financial services. By depositing with Comun, you are guaranteed the same security of a traditional bank account, with insured deposits up to $250,000¹, ensuring financial stability for you and your family.

Secure and Fast Remittances

For many immigrant and other families, sending money back home to their loved ones is vital. Comun makes this process safe and fast, allowing you to meet your financial obligations with confidence. Licensed through Service UniTeller, Inc.⁴, Comun ensures that your remittances reach their destination quickly, offering you a better opportunity to achieve financial stability.

Real-Time Notifications and Early Access to Funds

Stay informed with instant notifications: every transaction, every sign of activity is reported to you, ensuring peace of mind. Comun 's unique feature of providing early access to payroll deposits³ allows you to manage cash flow effectively, turning hard work into visible results sooner.

Worldwide Visa Enabled Security

Comun¹s Visa® debit card, processed through Visa USA Inc. ensures global acceptance and trust. Whether you are shopping locally or internationally, Comun s banking solutions accompany you around the world, ensuring that your funds are safe wherever you go.

Designed for the Unique Needs of Your Members

Comun is deeply committed to financial inclusion, designing products that address the unique needs of its members, especially for those who are just starting out or have difficulty connecting with traditional banking channels. From simple account setup to learning how to manage your finances, Comun is with you every step of the way.

Building a Community of Trust and Mobility

Comun s mission goes beyond simple banking services; it's about building community and helping millions of people navigate the complexities of financial systems. By offering tools that help you learn and grow, Comun supports your journey to financial freedom.

Conclusion: Comun

Comun customers are not just opening a bank account; they are entering a community dedicated to building financial stability and designing a future where every hardworking individual deserves an opportunity for upward mobility. Download the Comun app this week to begin your journey to financial freedom, equipped with the best tools to help you navigate, connect and thrive.

International Shipments

How to send money by Western Union? Complete guide and key tips

8 min of reading time

Western Union is one of the best-known remittance transfer options worldwide, due to its wide experience, coverage and accessibility. Many immigrants choose it to send money to their families from the United States.

If you want to optimize the money your family receives, it is very important that you understand the different transfer methods available in Western Union, as well as the commissions that each one generates.

That is why on this occasion we will explain how to send money by Western Union step by step, the requirements, its different modalities, as well as the advantages and disadvantages of opting for this international agency.

What is Western Union and how does it work to send money?

Western Union is a network specialized in international money transfers, through a large number of physical establishments, as well as online methods. It is an accessible way to transfer remittances, since it is not necessary to have a bank account to access its services.

It has two main methods for international money transfers: online and agency.

These are the requirements to send money by Western Union from the United States.

What is needed to make a Western Union money transfer?

1. Be at least 18 years old

2. Valid photo ID

If you go in person to a Western Union agency, you can present your passport and, in some cases, your driver's license.

In case you opt for the procedure through westernunion.com, you will need to upload a photograph of the document and possibly a selfie or other identification requirements.

3. Recipient Information

Make sure you have complete and correct information about the person who will receive the money:

- Full name (as it appears on your identity card)

- Recipient's country and city

- Method of receipt (cash, bank deposit or other)

- Payment method (card, bank account or cash)

Comparison between Western Union and Comun

| Platform | Commission | Exchange rate (USD - MXN) | Pagas | Estimated total received |

|---|---|---|---|---|

| Western Union | $4.99 - 15 USD | 1 USD = 16.70 MXN*. | 300 USD + commission | 4,900 - 5,010 MXN |

| Comun | From 2.99 USD, up to applicable limits | 1 USD = 17 MXN*. | 300 USD + commission | 5,100 MXN |

*Please note that the exchange rate is subject to change at any time.

In addition to offering more favorable commissions and exchange rates for international money transfers, Comun allows you to send money digitally from home 365 days a year, including holidays, which can be affected by longer waiting times due to higher customer volume.

Steps to send money by Western Union: Online and in person

Currently, with Western Union you can make international money transfers from the U.S. through the website, mobile application or in person.

online transfer with Western Union

In case you prefer to send money online by Western Union, just follow the steps below:

Login or register on their platform

Remember that in order to open a Western Union account you must have the above documents, as well as the identity verification.

Then, log in to the Western Union application or website.

Select destination country and amount

At Western Union you can choose from a variety of destinations in Latin America and the world, such as Mexico, Dominican Republic, Colombia, Argentina, among others.

Choose payment method

Western Union offers a variety of payment methods, including credit card, debit card, bank account deposit and cash payment.

Enter the recipient's data

Be sure to write your recipient's information correctly.

Confirm and get tracking number (MTCN)

Once you have entered the data, confirm that they are written correctly and confirm. Afterwards, you will be able to obtain a tracking number to verify the transaction.

money transfer at a Western Union agency

If you prefer to make the transfer in person, please follow the steps below:

Locate an agency near you

To locate the agency closest to you, log in to the website and select the "Find Location" option, then enter your zip code and review the options.

You can also call Western Union at 1-800-325-6000 to request customer service information.

Fill in the transfer form

Go to the window and ask for the transfer form that you will have to fill in with the same information that we explained for the online form.

Delivers the money and pays commissions to the agent

Once you fill out the form correctly, pay the agent the total amount plus the commission generated.

Receive tracking number (MTCN)

Finally, receive the tracking number and share it with the recipient so that he/she can collect the money transfer correctly.

Advantages and disadvantages of using Western Union for your remittances

Western Union is a popular alternative for sending remittances securely and quickly, and is used by thousands of immigrants in the United States every month.

Here are the main advantages and disadvantages of sending money with Western Union.

Advantages

Broad global coverage and physical presence

Western Union allows you to send money almost anywhere in the world, since it has approximately 500,000 agencies distributed in more than 200 countries. It is even possible to send money to rural and hard-to-reach areas.

Speed in cash shipments

In case you need to send money urgently, Western Union has a cash transfer option, which is available for collection within minutes.

Track record and brand recognition

Western Union has more than a century of experience in the market, so you can be sure of its reputation and security to send money through its network.

Disadvantages

High commissions

Generally, the smaller the amount to be sent, the higher the fee. The fee varies depending on the method of payment and transfer, but ranges from $4.99 to $15 USD, regardless of the exchange rate.

Uncompetitive exchange rate

In addition to the initial commission, you must consider the reduction implied by the currency exchange rate, which is taken at a less competitive margin than the market, so your family members will receive less money compared to other options.

transfer limits

For users with non-verified accounts, the transfer limit is 3,000 USD per transaction. While for verified accounts, the limit is 50,000 USD.

Less clarity in the commission structure

Western Union fees are variable and depend on several factors, such as destination country, payment method, transfer method and total amount.

Comun: A fast, transparent and inexpensive alternative for sending money to your family

There is no doubt that Western Union is one of the most prestigious remittance transfer services, due to its long history and ease of access to its services. However, it is important for users to choose the option that best suits their needs.

Before making a money transfer, it is essential that you are very clear about the fees and additional costs, otherwise, your family could receive less money without prior notice.

Comun is the comprehensive solution that facilitates the transfer of remittances at a fairer price.

In addition, it offers you:

- App mobile is also available in Spanish and allows you to easily send money to more than 17 countries in Latin America!

- Your first money transfer will be free and thereafter you will pay a fee starting at $2.99 USD per transfer, up to the applicable limits.

- You need a mobile device to open your account, your country's official identification (passport, consular registration, driver's license, among others) and a U.S. residential address.

- 24/7 customer support available in English.